Background

Falcon Oil & Gas Australia Limited (“Falcon Australia”) is a c.98% owned subsidiary of Falcon Oil & Gas Ltd.

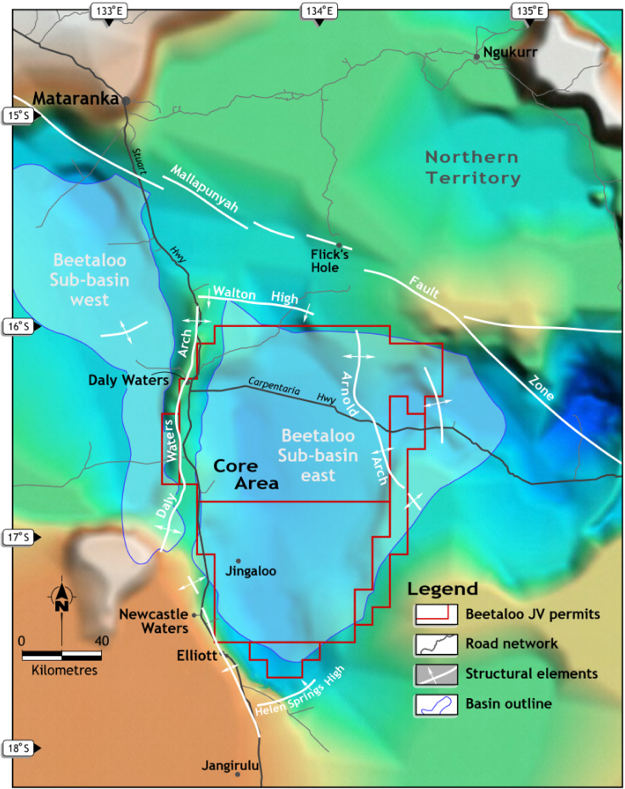

Falcon Australia is one of the two registered holders of approximately 4.6 million gross acres (~ 18,619 km2), 1 million net acres, of three Exploration Permits (EP 76, EP98 and EP117) in the Beetaloo Sub-basin, Northern Territory, Australia with Tamboran (B2) Pty Limited appointed as operator for the joint venture. The Beetaloo Sub-basin is located 600 kilometres south of Darwin, close to infrastructure including a highway, a pipeline and a railway, offering transport options to the Australian market and beyond via the existing and developing liquified natural gas capacity in Darwin.

The Beetaloo Sub-basin is a Proterozoic and Cambrian tight oil and gas basin. In its entirety, the Beetaloo Sub-basin covers approximately 8.7 million acres (~ 35,260 km2) and is a relatively underexplored onshore exploration basin. The area is also remote and sparsely populated. Considering all these factors, the Board believes the Beetaloo Sub-basin has shale oil and shale gas potential.

For the latest new releases related to the Beetaloo asset please refer to the press release section of the website here.

For the most recent of all activities please refer to the Beetaloo section in the Group’s latest MD&A located here